Professional Liability

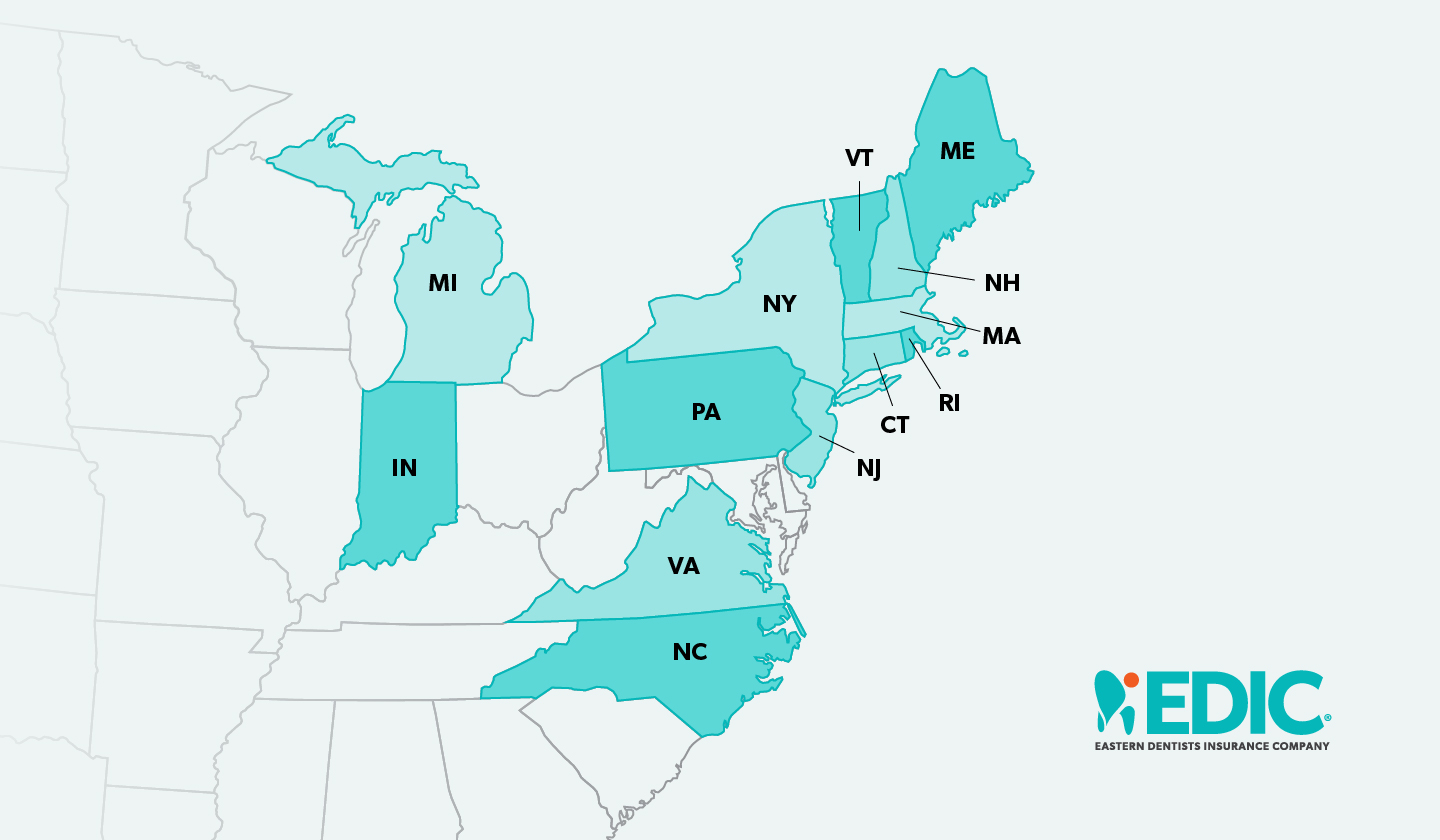

Coverage Areas

What Types of Professional Liability Policies Are Available?

Please toggle open the selections below to learn more

Claims-Made Policy

A Claims-Made Policy provides coverage for claims that are first made against an insured dentist and reported to the company during the current policy period. The claim must have occurred on or after the retroactive date and on or prior to the termination date of the current policy.

Occurrence Policy

An Occurrence Policy provides coverage for a claim that occurs during the policy term, no matter when the claim is reported. Even if the dentist no longer has the policy in force, as long as the claim occurred when it was in force, the claim will be covered.

Moonlighting Policy

EDIC offers a moonlighting policy for those dentists who engage in clinical activities that exceed the parameters of their full-time professional liability policy with another carrier. Moonlighting policies are written on an occurrence basis only and allow for 10 (ten) hours a week chair-side.

Corporate Policy

Whether you are a sole proprietor or a legal owner of a multi-owned entity, EDIC has coverage options for your corporation and its associates.

What Does Your Liability Policy Include?

- Professional liability insurance for each occurrence

- Free prior acts coverage eliminates the need to purchase tail coverage from a prior carrier

- Free tail on death or disability

-

Free continuous tail coverage on retirement

(for early retirement at age 50 and with at least 5 years of EDIC coverage) - Cost-effective coverage for hygienists and assistants

- Consent to settle clause in the EDIC policy

- Risk management education and programs

- Aggressive claims management

- Early intervention via our 800 hotline to avoid incidents becoming claims

- Premium discounts available:

*At this time, the $50 New Dentists policy is not available in New York.